Introduction

In today’s rapidly changing business landscape, organizations face numerous challenges and uncertainties. To navigate these complexities, businesses must adopt effective risk management strategies and ensure compliance with legal requirements. This article delves into the world of risk management software and explores the crucial role it plays in facilitating legal compliance. We will examine the features, benefits, implementation process, and the significance of legal compliance in maintaining business integrity.

Section 1: Understanding Risk Management Software

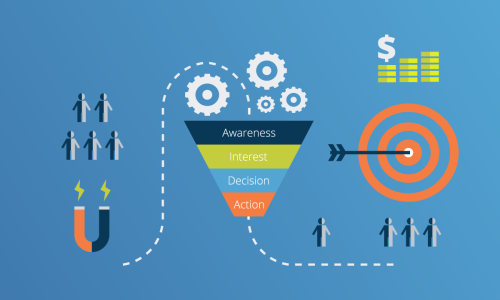

Risk management software refers to a suite of tools and applications designed to identify, assess, and mitigate risks within an organization. These software solutions streamline the risk management process by providing a centralized platform for risk assessment, tracking, and reporting. The key features of risk management software include risk identification, analysis, monitoring, and reporting, enabling businesses to proactively manage risks and make informed decisions.

Section 2: The Role of Risk Management Software in Business

Effective risk management is essential for business sustainability and growth. Risk Management Software plays a crucial role in this process by helping businesses identify and manage various types of risks. From operational risks, such as supply chain disruptions or cybersecurity threats, to financial risks like market fluctuations or credit defaults, risk management software provides tools to assess, mitigate, and monitor these risks effectively. Additionally, software applications facilitate project risk management, enabling organizations to identify potential project delays, budget overruns, or resource constraints.

Section 3: Implementing Risk Management Software

Implementing risk management software requires careful planning and consideration. Organizations should define their risk management goals, identify the relevant stakeholders, and establish a clear implementation roadmap. Integrating risk management software with existing systems, such as enterprise resource planning (ERP) or customer relationship management (CRM) systems, ensures seamless data flow and enhances the overall risk management process. Adequate training and education for employees are essential to ensure the software’s effective utilization and maximize its benefits.

Section 4: Legal Compliance and Its Significance

Legal compliance refers to the adherence to laws, regulations, and industry standards applicable to a particular business. It plays a critical role in maintaining business integrity, protecting stakeholders’ interests, and avoiding legal and financial penalties. Compliance spans various areas, including data privacy, consumer protection, labor laws, environmental regulations, and more. Failure to comply with these legal requirements can result in reputational damage, loss of customer trust, and severe legal consequences.

Section 5: Legal Compliance and Risk Management Software

Risk management software can greatly assist businesses in ensuring Legal compliance. By centralizing compliance activities and automating processes, software solutions help organizations monitor and document compliance efforts effectively. These tools provide functionalities such as tracking regulatory changes, managing policy compliance, conducting audits, and generating reports. By streamlining compliance procedures, risk management software helps businesses stay up-to-date with changing regulations, minimize compliance risks, and demonstrate their commitment to legal requirements.

Section 6: Choosing the Right Risk Management Software

Selecting the right risk management software is crucial to effectively manage risks and ensure legal compliance. Businesses should consider several factors when evaluating software options. These factors include the software’s features, such as risk assessment methodologies, reporting capabilities, and integration capabilities with other systems. Scalability and customization options are essential to accommodate business growth and specific requirements. Cost considerations, including software licenses, implementation costs, and ongoing maintenance, should also be weighed against the expected return on investment.

Conclusion

In an increasingly complex business environment, risk management software and legal compliance are vital components of successful operations. By leveraging risk management software, businesses can proactively identify and mitigate risks, enabling them to make informed decisions and maintain a competitive edge. Simultaneously, legal compliance ensures business integrity and protects against potential legal and reputational risks. By combining risk management software and legal compliance practices, organizations can streamline their operations, enhance stakeholder trust, and achieve sustainable growth.